Risk, Reward and Parent PLUS Loans: What Happens When Parents Can't Pay

Parent PLUS loans hide a second debt burden. We analyzed debt burdens to show how family finances change when parents borrow too—and who gets squeezed.

Last week I introduced a framework for thinking about risk and reward in higher education by mapping student loan burden at the 25th and 75th percentile of earnings. Today, we're going expand on this thought by looking at this with Parent PLUS loans as a part of the equation.

As I discussed in The Family Debt piece, I don't think about this as "Student Debt." I think about it as Family Debt.

In that piece, we saw that parents borrow more than students at private nonprofits. At some schools, it's not even close—4x, 5x what the student takes on.

There's a common theme I've heard a lot: that people who don't go to college, or who choose a "lower ranked" school, are being irrational.

As someone who made that decision, I don't think that's true.

I ended up getting a Chicago MBA. Worked at an investment bank. Raised millions of dollars.

I'm fully capable of making good, logical decisions. And I chose not to go to college out of high school. Not because I didn't want to. Not because I didn't see the value in it. Because I couldn't take that risk.

It's easy to think "Well, maybe these kids don't really know enough. So let's tell them what they don't know." I'm here to tell you that maybe it's not that simple.

They're just dealing with a different set of information than you or I, or anyone who can view college from 10,000 feet.

Let's see this story in data form:

Methodology: How We Calculate Family Burden

Before we get into the numbers, a quick note on methodology.

For student debt alone, we calculate burden against what the student earns. If you're at the 25th percentile of earners from your school, we ask: what percentage of your discretionary income goes to loan payments?

For family debt, we pool everything together—because that's how families actually work. The formula:

Family Burden = (Student Payment + Parent Payment) ÷ (Student Income + Parent Income)

We are going to run this calculation under different assumptions about parent income: - $83,000 — the U.S. median household income - $45,000 — Pell grant territory, representing low-income families

And we run one more scenario: what if the student ends up paying everything? Parent PLUS loans are legally the parent's obligation, but family dynamics don't always follow the paperwork. If parents can't pay, the burden often shifts to the student informally.

These four scenarios tell very different stories.

Data sourced from the College Scorecard (2024 release), U.S. Department of Education.

Student Debt Burden on Families.

Here's what the data shows across All four-year schools.

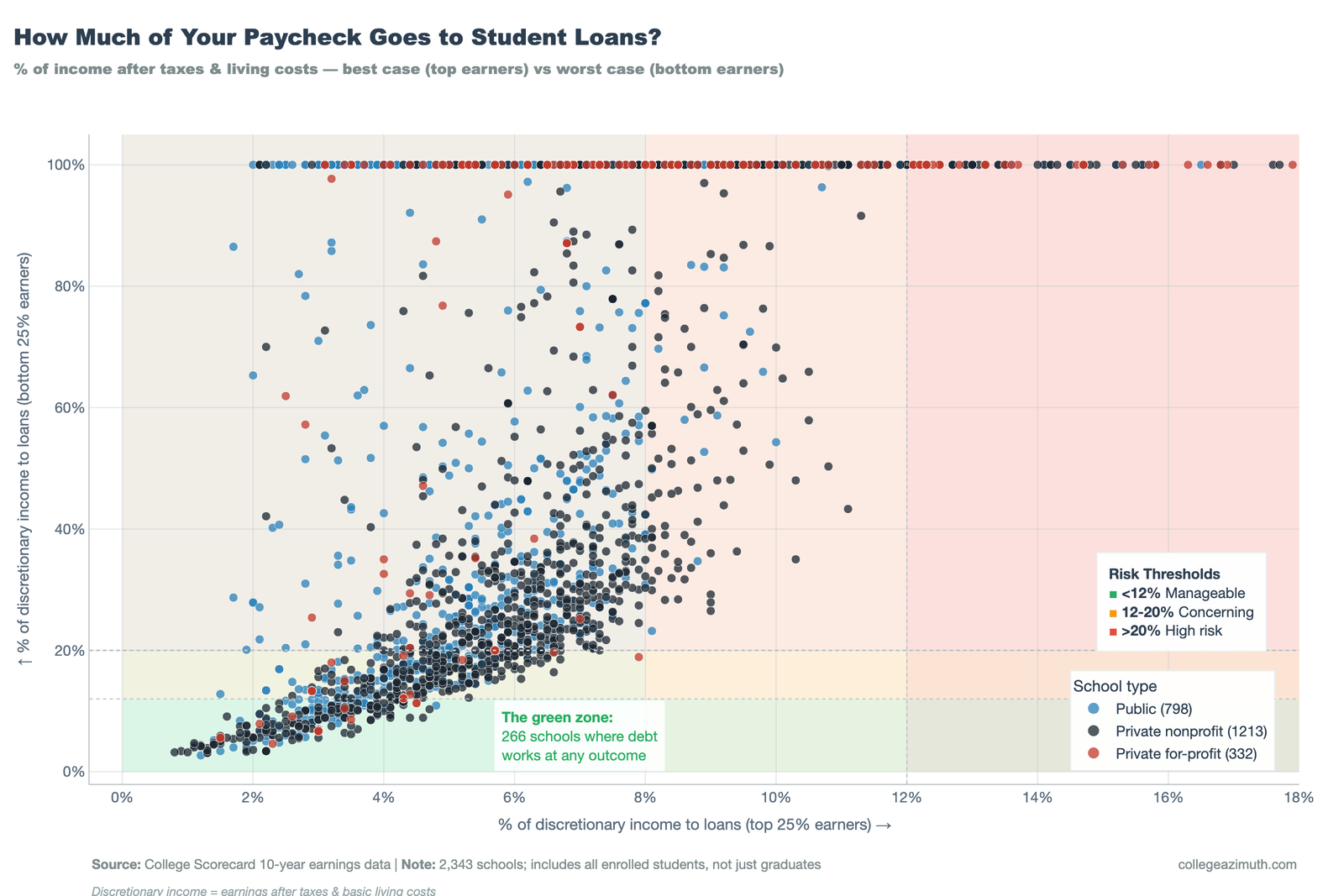

Scenario 1: Student debt only

For reference, let's share the chart we shared last week looking only at student debt.

~286 schools are in the green zone (burden under 12%). This is the baseline—what most people look at when they talk about "student debt." A lot of schools don't look great even here, but there's a cluster where the math works.

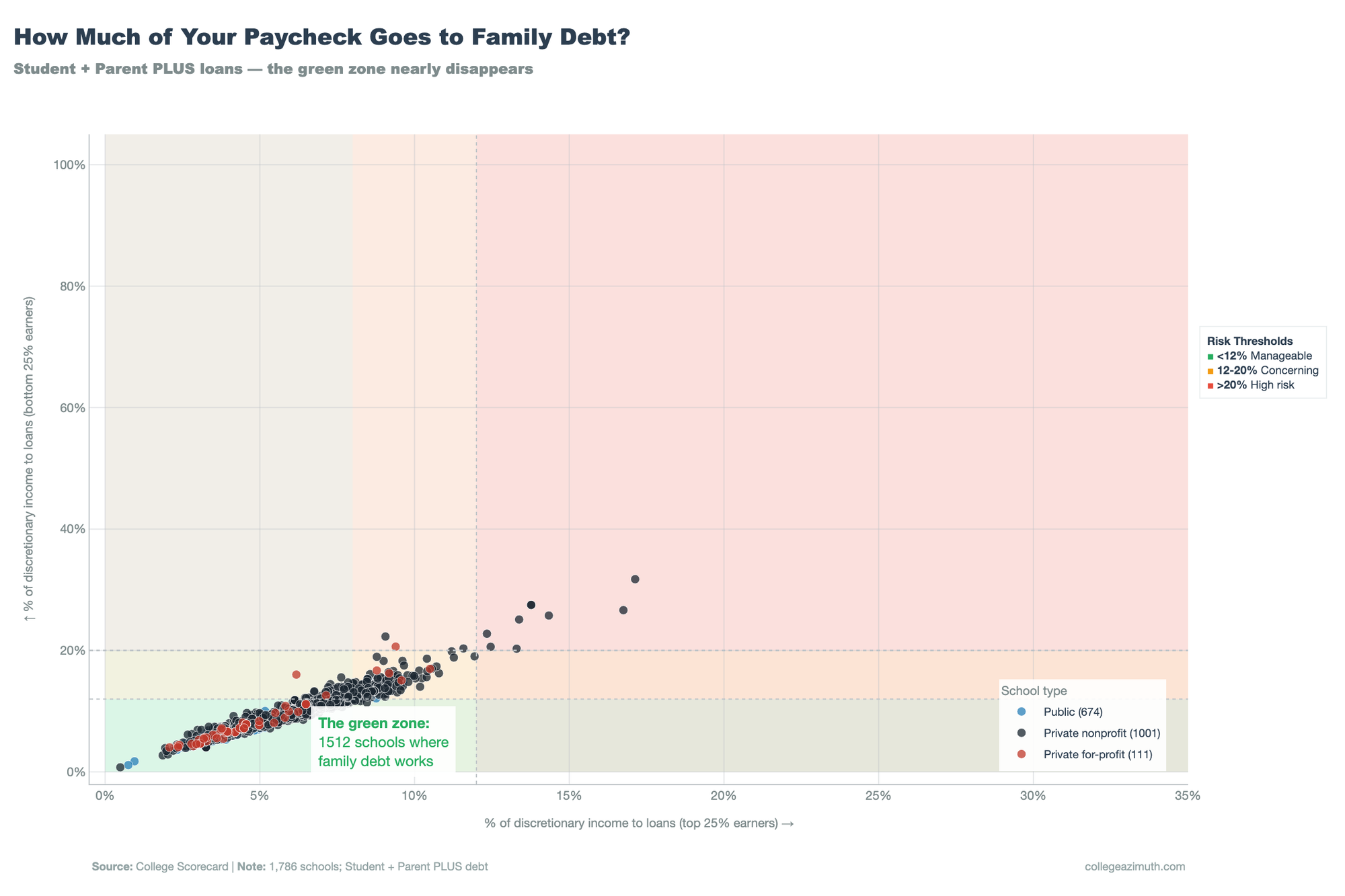

Scenario 2: Family pools income ($83k parent)

Our next scenario does two things. 1) It includes the median Parent Plus loans, and assumes the family makes the Median family income (~83k).

1,512 schools in the green zone. This...mostly works. There are some concerning schools in the data, but at most four year schools the parents are able to pick up a lot of the slack which exists for the students.

This, of course assumes no other debts, no other issues, no setbacks but this is the optimistic case for a family looking to pay for school.

Scenario 3: Family pools income ($45k parent)

For the next scenario we look at a typical "Pell Family" or those who make under 45k a year. This represents about a third of families in the U.S.

The results? Only about 182 schools in the green zone. A pretty big difference in outcomes here. Even when things go well, a good chunk of families are still struggling.

There are two ways to think about this.

1) The notion that going to college works for low-income families is really dependent on price. It can, but there are a lot of scenarios where it doesn't.

2) There's a thin line between okay, and not okay when it comes to this. If you're a higher income family that has their own debts, or other responsibilities you're not that far away from it not working out for you.

The Sensitivity to price here is a real, and don't think that just because it might look alright on the median that you're gonna be okay.

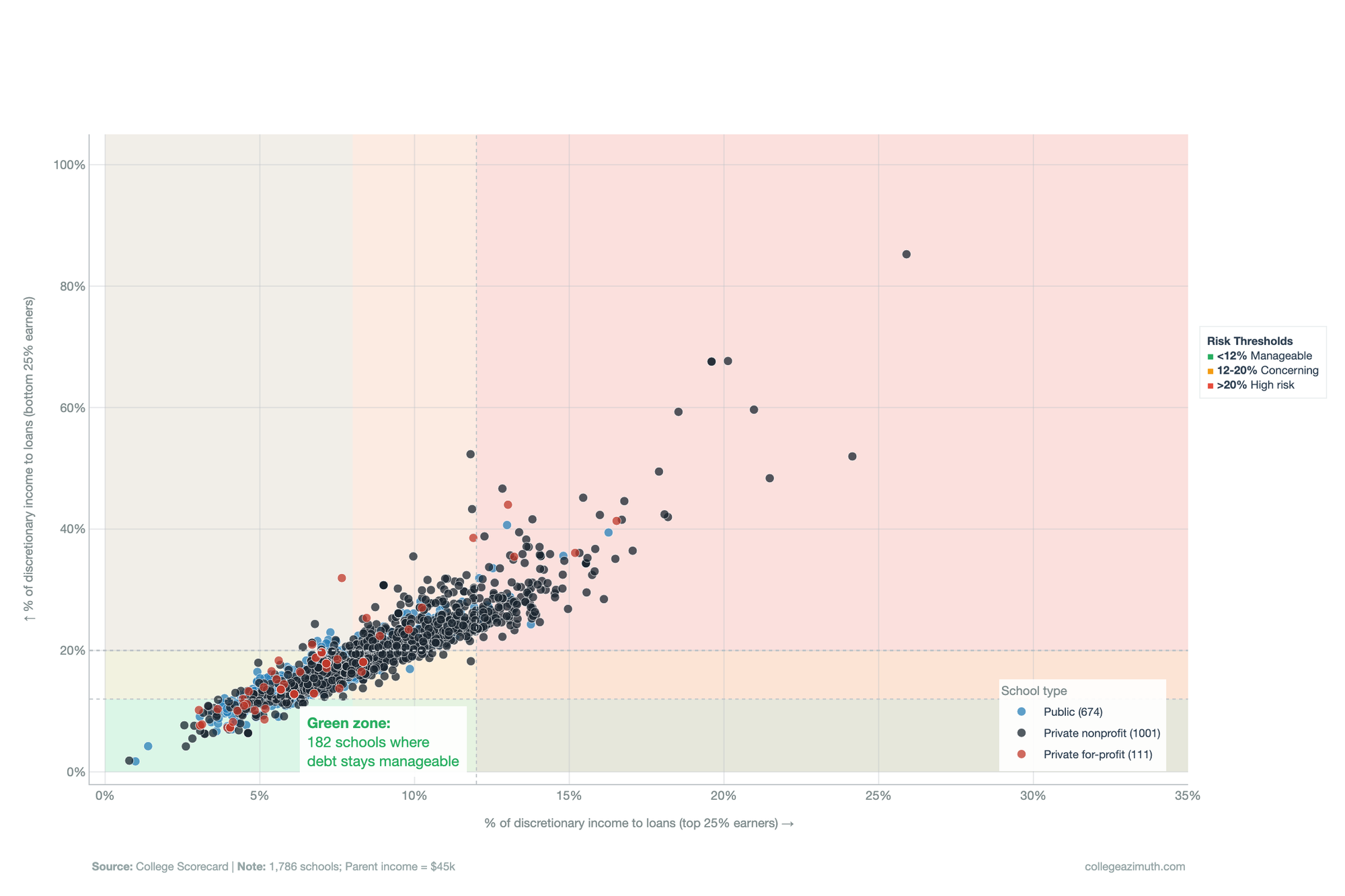

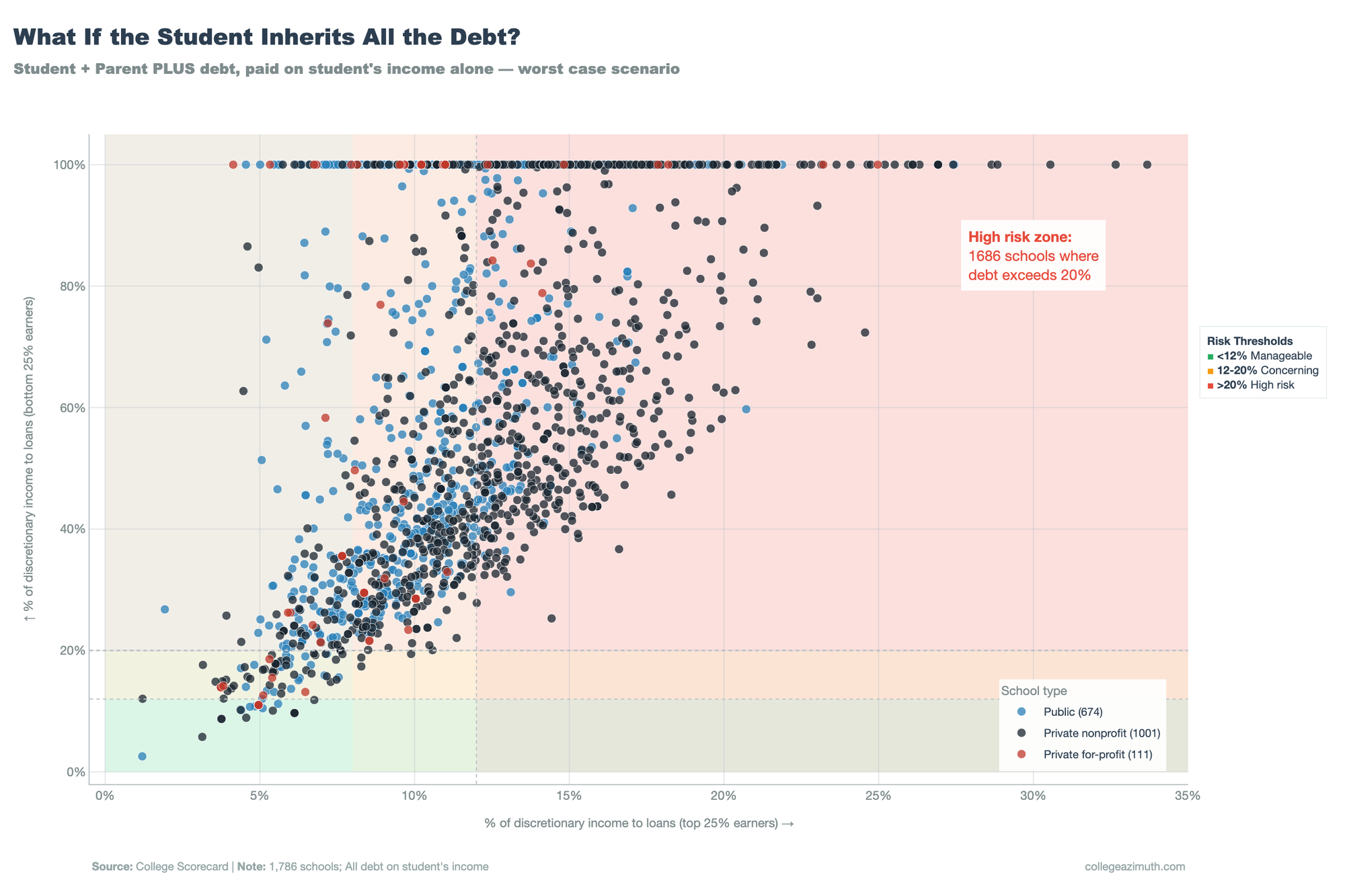

Scenario 4: Student covers all debt

So this is what applies to a lot of students, even if their parents take out debts. Parent PLUS is legally the parent's debt. But what happens when parents can't pay? When they retire, get sick, or just... don't?

The debt doesn't disappear. It lands on someone. Often the student—through family pressure, refinancing, or just picking up the payments because the alternative is watching your parent's credit collapse.

In this case, the vast majority of schools land in the high-risk red zone (burden over 20%).

Under this scenario, nearly every school in the country becomes a high-risk bet, regardless even in the cases where the student does well.

As a student, you've done everything right. You graduated. You got the good job, and yet..it still isn't enough in most cases. That's devastating. FWIW, this is where I would have been if I had listened to that guidance counselor who told me to just go, and it'll work itself out.

Please don't do this.

What This Means and why this matters.

The "family debt" framing matters because families don't operate in silos.

For median-income families ($83k household), pooling resources can actually make the math work. The combined income base is large enough to absorb combined debt at most schools.

For low-income families, the ones most likely to need Parent PLUS to fill the gap pooling doesn't help much. You're combining debt with... not much income.

And the elephant in the room: what happens when parents can't pay?

Parent PLUS is legally the parent's debt. But debt doesn't care about legal technicalities. If mom retires and can't make payments, if dad gets sick, if the economy turns—that pressure doesn't evaporate. It lands somewhere. Often on the student.

Under the "student covers all" scenario, nearly every school in the country becomes a high-risk bet. 1,686 out of 1,786 four-year schools end up in the red zone.

In The Family Debt piece, I talked about sitting with my grandmother over Thanksgiving, walking her through how a $15,000 loan would work. That story plays out nearly a million times a year and that story is probably one of the better ones.

We brought up the Debt PLU$ Project previously who interviewed 66 families in 2025.1 What they found: families navigate in a fog. PLUS loans are gap fillers, decisions made under pressure. Parents feel stretched thin.

But "stretched thin" undersells it. People make bad assumptions guided by well meaning folks like my guidance counselor or the folks at think tanks that "it'll all work out" but that's not true a lot of the time.

A Georgetown survey found that retired parents who carry both their own student debt and Parent PLUS loans are often living paycheck to paycheck and can't handle a small emergency if it comes up.2 Seventy percent of those not yet retired say their retirement savings plan is not on track.

Forty percent of older borrowers skip meeting their own healthcare needs versus 25% of people without this debt.

In 2015, 40,000 disabled or retired Parent PLUS borrowers had their Social Security benefits garnished due to default.3 That number has grown since.

As one borrower told Alexis Wray formerly of the Student Borrower Protection Center: "Folks are really entering retirement with not only loans for their own education, but then these Parent PLUS loans from their children's education. So folks feel really trapped and they feel like there's no way out of it."4

The debt doesn't stay with the parents. Research shows that parents carrying education loans are 67% less likely to save for their own children's college.5 One generation borrows, can't save, and the next generation starts further behind.

The HBCU Reality

This brings me to the HBCU issue, and the racial wealth gap. Many of the schools where this math is hardest are HBCUs.

That's not because HBCUs (or any of the schools who look bad here) are bad schools. HBCUs serve a real and important function in American higher education. They've produced generations of leaders, professionals, and scholars—schools like Howard University have shaped American history.

But HBCUs are chronically underfunded. Their students often come from families with less financial cushion. They borrow more to attend. The debt-to-earnings math then becomes harder. As we often say in the black community "You end up having to work twice as hard, for half as much".

The Century Foundation tracked what happens to Parent PLUS borrowers over time.6 Ten years after entering repayment, borrowers whose children attended top Black-enrollment colleges still owe 96% of their original principal. At predominantly white-enrollment schools: 47%.

Half of white families with Parent PLUS loans have a net worth of at least $100,000. For Black and Latino families, one in four.

At HBCUs, Parent PLUS makes up more than 15% of all financial aid dollars. At non-HBCUs, it's 9%. Eighty percent of Parent PLUS recipients at HBCUs also receive Pell Grants. Families with the least margin taking on the most debt.

What This Means For You.

Some Specific thoughts for different populations.

If you're a student: - Know that the debt conversation doesn't end with your loan - Ask your parents—directly—what they're planning to borrow - Don't let them shield you from it—that protection can backfire

If you're a parent: - Run the math on your own income, not your hopes - If you're earning around $83k, don't have other debts or responsibilities then pooling with your student's future income might work If you're closer to $45k, be very careful Ask yourself: what happens if I can't pay? Will that burden fall on my kid?

If you're a counselor or advisor: - Stop treating Parent PLUS as "the parent's problem". It's family debt, the student's future is tied to whether mom and dad can retire Or whether they end up passing the burden along

The green zone schools still exist. But which zone you land in depends on your family's income, not just your school's sticker price.

That's not to say you shouldn't do this. There are plenty of reasons to pursue a school even if the math is hard. But I'd be remiss if I didn't say that you gotta do a little bit more work to make sure the math works for you personally.

Finally the caveat on all of this:

I analyze publicly available data to surface patterns and trade-offs in higher education financing. I am not a financial advisor, college counselor, or legal professional. This analysis may contain errors, and the data we use—while sourced from federal databases—has its own limitations, lags, and blind spots.

Your situation is yours. Before making decisions about borrowing, enrollment, or anything else that affects your financial future, talk to a qualified professional who can evaluate your specific circumstances. We're here to help you ask better questions, not to answer them for you.

Footnotes:

- Burmicky, V., Odle, T., Wright-Kim, J., McFadden, M., & Carter, D. (2025). Debt PLU$ Project Qualitative Report. University of Michigan, University of Wisconsin-Madison, Howard University. https://protectborrowers.org ↩

- Georgetown Center for Retirement Initiatives (2023). New Survey Shows Continued Challenges for Older Americans with Student Loan Debt. https://cri.georgetown.edu/new-survey-shows-continued-challenges-for-older-americans-with-student-loan-debt/ ↩

- U.S. Government Accountability Office (2015). Social Security Offsets for Federal Student Loan Debt. https://www.gao.gov ↩

- Wray, A. (2024). Interview cited in Reckon, "Parent PLUS Loans: The Good, Bad and Ugly." https://www.reckon.news/family/2024/07/parent-plus-loans-the-good-bad-and-ugly-according-to-the-student-borrower-protection-center.html ↩

- Financial Planning Association (2020). The Effect of Student Loans on Parental Views of Education Financing. https://www.financialplanningassociation.org/article/jun20-effect-student-loans-parental-views-education-financing ↩

- Granville, P. (2022). Parent PLUS Borrowers: The Hidden Casualties of the Student Debt Crisis. The Century Foundation. https://tcf.org/content/report/parent-plus-borrowers-the-hidden-casualties-of-the-student-debt-crisis/ ↩